What You Need to Know About Recessions

Over the past five years, economists have been talking pretty consistently about recession. In fact, here are a pair of headlines from Bloomberg, exactly one year apart. The first headline makes us feel as though the recession is inevitable, and the second says the economy continues to defy the inevitable.

This would be funny if it weren’t so serious. The market responds to expectations, and constant expectations of recession have been a drag on the market. That’s not the only thing impacting the markets. The rise in interest rates is having a very real impact, particularly on interest rate sensitive sectors.

But today I want to discuss recession. What is it? Why does it feel like the economy is weak, if economic indicators are in fact strong? Let’s discuss.

What is a Recession?

A country’s gross domestic product (GDP) represents the value of goods and services produced. For the United States, this is estimated to be about $26 trillion this year, compared to was $20.5 trillion in 2018.

All economies go through cycles of expansion and contraction. A recession is generally defined as two consecutive quarters of GDP contraction. (A depression represents a deeper and generally more protracted GDP contraction).

Leading up to the COVID-19 pandemic, the U.S. economy had been expanding for 10 years. But then the Great Lockdown caused massive unemployment, a stock market crash, and it pushed the U.S. into recession.

But this recession wasn’t like other recessions. The economic contraction was steep, but brief. There was a staggering 31.4% GDP plunge in the second quarter of 2020, but the government responded with massive stimulus spending. The end result was the shortest recession in U.S. history, at only two months.

Due to the unique circumstances, many economists have discounted this recession. As a result of this atypical recession, economists continue to expect a “real” recession. To understand why, let’s examine the normal business cycle.

The Business Cycle

A normal business cycle consists of four phases.

In the early cycle phase, the economy experiences a sharp recovery after a recession. Economic indicators like GDP and industrial production turn from negative to positive as growth accelerates. More credit availability and low interest rates aid profit growth. Business inventories are low while sales grow rapidly.

The mid cycle phase is usually the longest lasting, with moderate but steady economic growth. Momentum builds in economic activity, credit expands strongly, and corporate profitability remains healthy as monetary policy turns neutral. This phase reflects most of the last decade.

During the late cycle phase, the economy nears its peak activity level. Growth stays positive but begins slowing down. Rising inflation and a tight labor market start crimping profits and spur higher interest rates.

In the recession phase, overall economic activity contracts, profits decline, and credit tightens considerably for households and businesses. Interest rates and business inventories gradually fall, laying the foundations for the next recovery.

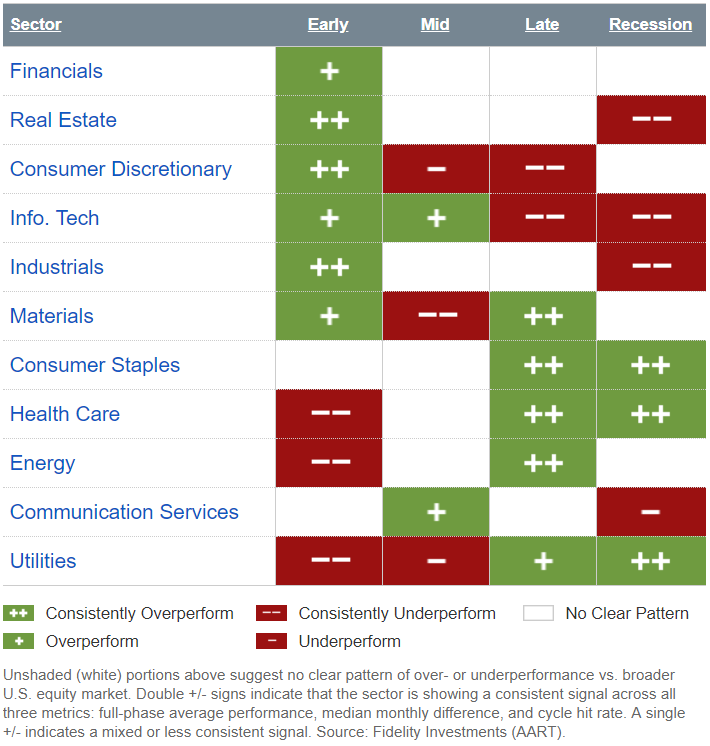

Certain sectors have historically fared better during different phases of the business cycle, as seen in the following table.

Source: Fidelity Investments

But the flash recession in 2020 didn’t fit the typical pattern, which is why it is discounted by economists who continue to expect a “real” recession.

Normally, if we are in the cycle just before recession, we would expect sectors like consumer staples and utilities to fare best. In fact, they are among the poorest sector performers in 2023.

Why it Matters

Because recessions mark a downturn in economic activity, stock market corrections and recessions go hand-in-hand. A recession can cause the stock market to plunge, or vice versa. In 2008, at the start of the Great Recession, the S&P 500 declined by 37%. In the 2020 recession, the major stock market indices quickly dropped by 20% to 30%.

WATCH THIS VIDEO: Navigating Treacherous Financial Waters

The irony of the situation is that markets are forward-looking. Investors tend to become very cautious when recession indicators begin to flash. Thus, all the warnings of impending recession have kept many investors on the sideline.

Markets generally begin to recover during the recession. So, if the much-anticipated recession would finally arrive, investors would likely breathe a sigh of relief and feel better about putting more money into the markets.

Reality and Perception

The U.S. recently released third quarter economic data. U.S. GDP grew at a 4.9% annual pace in the third quarter, much better than expected. This would seem to imply that the economy is healthy, and that recession is far away.

There are a couple of reasons economists discount this expectation. One of those is high interest rates, which do eventually impact consumer spending. But another factor impacting consumer spending is consumer perception.

There is presently a disconnect between the economy and how people feel about the economy. Most people base their opinion on the economy on how much they are paying for gasoline, groceries, and rent. They aren’t looking at GDP and wage growth.

People feel the economy is bad because they are paying more for things — even if they are earning more money. That perception will ultimately impact their spending, and that itself can help push the economy into recession.

The economy may appear strong for now based on headline GDP numbers, but underlying risks remain in play. As the business cycle enters its late stage, slowing growth and ongoing inflationary pressures seem probable.

While the timing is unclear, investors should prepare portfolios under the assumption that an overdue cyclical recession looms. Staying diversified, focusing on quality, and keeping a long-term perspective helps endure the volatility recessions bring.

PS: Spooked by the latest bout of market volatility? You don’t have to sit on the sidelines. For robust gains with mitigated risk, I suggest you consider the advice of my colleague Jim Pearce, chief investment strategist of Personal Finance.

Personal Finance, founded in 1974, is our flagship publication and it has helped investors build wealth for nearly 50 years.

Case in point: If you had taken the initial recommendation of Personal Finance to buy Chevron (NYSE: CVX), and held on, you’d be sitting on a whopping return of nearly 3,200% (that’s not a typo).

Want to get aboard “The Next Chevron?” Click here for details.

Subscribe to the Investing Daily video channel by clicking this icon: