Crypto Roundup: Your Weekly Dose of Cryptocurrency News and Tips

Hear that ringing sound? It’s not your ears playing tricks on you. School is back in session.🎒

When you’re a kid, nothing brings you down like the end of summer and the start of a new school year. But around these parts, we’re skipping the usual subjects and getting right to the fun stuff.

Welcome to Crypto Roundup, where every week is a fresh lesson in the ever-evolving world of digital currencies. Whether you’re a crypto scholar or the new kid in class, our goal is to be your weekly study guide. From blockchain basics to the latest regulatory developments, we’ve got the syllabus to keep you informed and ahead of the curve.

So, grab your notebooks and let’s dive in! 📚🖋️

📉 Crypto Market Flash Crash

Crypto investors must have been down in the dumps on Thursday. It was a rough day for Bitcoin, which saw a 7% drop in just 20 minutes, plunging below the $26,000 mark. Ethereum wasn’t spared either, with a near 10% dip. The crypto market’s tumble triggered a whopping $800 million in liquidations.

The crypto crash coincided with China’s massive property developer, Evergrande Group, filing for Chapter 15 bankruptcy protection in New York. Adding fuel to the fire, the Wall Street Journal reported that Elon Musk’s SpaceX wrote down its Bitcoin holdings by $373 million and offloaded an unspecified amount.

Other major cryptos like Ripple, Shiba Inu, and Litecoin also felt the heat, each dropping by at least 14%. Despite recent enthusiasm from institutional investors, including BlackRock’s application for a spot bitcoin ETF, the SEC’s slow pace in approving these applications seems to be dampening spirits.

Visa Wants To Help Your (Ethereum) Gas Problem ⛽🪙

Visa has successfully tested a new system that simplifies the payment of Ethereum’s notorious “gas fees.” For those scratching their heads, every transaction on Ethereum requires these fees, and let’s just say they’re not always easy on the pocket. Visa’s solution? Allow users to pay these fees directly using their Visa cards.

Why is this a big deal? Well, on the face of it, crypto poses a threat to the payments giant. After all, why would we need Visa if decentralized systems like Ethereum were to gain purchase (see what I did there?)?

Luckily for Visa, they’re a little more forward-thinking. Because really, it’s the legacy payment rails that are threatened. Credit and debit cards take 1-3 days. ACH transfers (between banks) can take 1-3 days. And checks (remember those?) can take up to a week.

Under normal conditions, a payment on the Ethereum network can settle in about 13 seconds.

In other words, if other problems like gas fees can be solved by developers (and Visa), those payment forms I mentioned above will be considered Stone Age stuff. And if Visa can help address one of the major pain points of enabling ETH transactions, then it’ll have a first-mover advantage in attracting users and merchants to its platform. Pretty cool.

Why Do Europeans Have All The Fun? 💶

So remember last week when I told you that the SEC’s deadline for deciding on Ark’s Bitcoin ETF was on Sunday (the 13th). Yeah, about that…

It looks like they punted on that one. But, on a related note, we did get news of the first Bitcoin ETF in Europe.

London-based Jacobi Asset Management has unveiled Europe’s first spot bitcoin exchange-traded fund (ETF), and it’s now trading on Euronext Amsterdam. The ETF goes by the catchy ticker “BCOIN,” and Fidelity Digital Assets has got it covered for those wondering about custody.

A bit of history here: Jacobi originally got the nod for this ETF in October 2021 and planned to list it in 2022. But a few hiccups in the digital asset market, like the Terra ecosystem’s collapse and crypto exchange FTX’s bankruptcy, made them hit the pause button.

Despite a barrage of applications to the U.S. Securities and Exchange Commission over the past few years, we still have yet to see a spot Bitcoin ETF. But with giants like BlackRock entering the fray with new applications, there’s a glimmer of hope on the horizon. Stay tuned.

Valkyrie Takes Flight With Ether Gambit 💸

While we wait for spot bitcoin ETF news, asset management heavyweight Valkyrie is making moves of its own. On August 16th, the firm filed with the SEC for an Ether futures exchange-traded fund (ETF). But instead of directly investing in Ether, Valkyrie’s ETF aims to purchase a slew of ETH futures contracts.

For the uninitiated, ether is Ethereum’s native coin, primarily used for peer-to-peer transactions on its decentralized network. We’re big fans of ETF over at Capital Wealth Letter. Why? Because Ethereum is the platform of choice for many developers. It’s where most of the interesting DeFi (decentralized finance) projects are located, which enable peer-to-peer digital exchanges.

Valkyrie isn’t alone in this race. Other major asset managers, including Grayscale, VanEck, and Bitwise, have also filed for Ethereum futures ETFs.

🕵️ Ark’s Insights

Meanwhile, the folks over at Ark Invest released some interesting data in their latest Bitcoin Monthly.

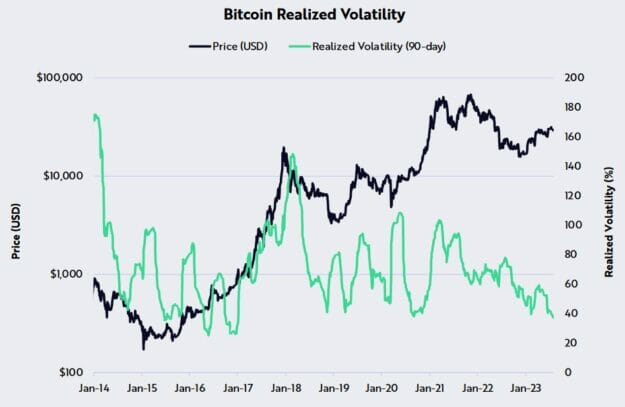

Among their findings, bitcoin’s volatility reached a 6-year low in July. That would suggest the potential for a big price movement in either direction.

Source: ARK Invest

Meanwhile, the supply of bitcoin held by long-term holders reached an all-time high of 74.88% of the circulating supply in July. This suggests many BTC holders are unbothered by the recent negative headlines and lack of price movement. They’re in it to win it.

For the technical-minded traders out there, Ark reports that, at the end of July, Bitcoin’s price stood above its 200-week moving average ($26,623) and its short-term-holder (STH) cost basis ($28,328).

Crypto Tip of the Week: Understanding DeFi

DeFi, short for “Decentralized Finance,” is a group of apps and services offering a wide range of financial services, from lending and borrowing to insurance and trading — all without the need for traditional banks or brokers.

DeFi operates without intermediaries, using smart contracts on blockchains, primarily Ethereum.

The goal: create an open-source, permissionless, and transparent financial service ecosystem.

So why the hype? In short, DeFi democratizes finance. It provides financial services to those without access to traditional banking systems, offers more competitive rates due to reduced overheads, and ensures full control of one’s assets. Plus, with DeFi, transactions are transparent, and users can earn interest on their crypto holdings.

For a deeper dive, check out Coinbase’s comprehensive guide.

Closing Thoughts

And just like that, our crypto class for the week is dismissed. Now, that wasn’t so bad, was it?

From market tumbles to the promise of DeFi, we covered a lot of ground this week. We hope you learned something — but don’t worry, there won’t be a quiz next week. Remember, we’re still in the early stages of this thing. So stay informed, be adaptable, and never invest more than you can afford to lose.

Whether you’re trading, hodling, or just here for the knowledge, we’ll see you next week.

P.S. Want to know more about our favorite ways to invest in crypto — and how to do it? You need to see this…

Our team thinks a select few cryptos are about to go on another monster run. And we just released a bombshell briefing about how you can profit. Go here now to learn more…

This article originally appeared on StreetAuthority.com.