Crypto Roundup: SBF Guilty On All Counts, Plus: HBD BTC…

Talk about dichotomies…

This week marked two important milestones in the history of cryptocurrency.

Yes, the first milestone I’m talking about is the Sam Bankman-Fried trial. We’ve dipped in and out of covering this trial over the past month or so. But in case you haven’t heard the news, the verdict is in.

I’ll give you a hint. Remember when we skipped covering the trial one week because I told you he wasn’t going anywhere? 🤣

I just can’t help myself. Anyway, our second milestone has to do with a rather special birthday.

I’m talking about Bitcoin’s birthday.

So, rather than machine-gunning our way through several stories in the crypto realm this week, I thought we’d spend some time on each one of these milestones.

Welcome to another edition of Crypto Roundup. Let’s get to it!

🧑⚖️ SBF: Guilty On All Counts ⚖️

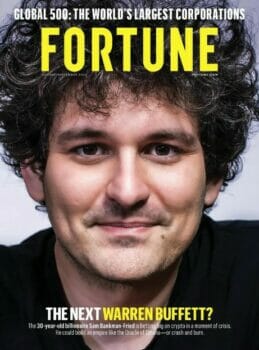

With one word from a group of 12 citizens last night, Sam Bankman-Fried (SBF), the former crypto boy wonder, was unceremoniously cemented in history along with the likes of Bernie Madoff and Jordan Belfort.

Guilty.

SBF’s fall from grace sent shockwaves across the crypto community. The 31-year-old founder of FTX was convicted on all seven counts of defrauding his cryptocurrency exchange’s customers. The deliberations only took four hours.

The courtroom drama took place over a month-long trial in a Manhattan federal court, where the prosecution unveiled an $8 billion theft rooted in sheer greed. During the trial, it was revealed that Bankman-Fried funneled money from FTX to his crypto-centric hedge fund, Alameda Research, despite public assurances of safeguarding customer funds.

The diverted funds were used for speculative ventures, vanity projects, luxury real estate, and hefty political donations to influence politicians and sway crypto legislation. FWIW, you can see how much (and where) SBF contributed in the 2022 midterm elections here, courtesy of OpenSecrets.org.

Bankman-Fried took the stand in his defense, acknowledging some operational missteps but denying any theft of customer funds. However, testimonies from his inner circle painted a different picture. That testimony seemed to resonate with the jury, leading to his conviction.

The gavel fell almost a year after FTX filed for bankruptcy, wiping out Bankman-Fried’s staggering $26 billion fortune overnight. The once-celebrated crypto mogul awaits a sentencing date set for March 28, 2024. His defense voiced disappointment but pledged to continue fighting the charges.

But this isn’t the end of the rap sheet facing SBF. Bankman-Fried is also queued up for a second trial on fresh charges, including alleged foreign bribery and bank fraud conspiracies.

Putting The Verdict Into Perspective

Once a crypto darling, SBF once graced the cover of magazines. Politicians gladly accepted tens of millions in partisan donations. Celebrities lined up for endorsement deals.

But now, the narrative has flipped. SBF’s conviction symbolizes a significant win for the U.S. Justice Department. Keen on purging financial market corruption, the prosecutors emphasized that fraud remains an age-old offense that won’t be tolerated despite the newness of the crypto industry.

As Bankman-Fried faces the possibility of decades behind bars, this case underscores the legal boundaries emerging within the burgeoning crypto sector. Perhaps one day, we’ll look back at this trial as a landmark signaling the end of the “Wild West” days of crypto .

🎂 HBD BTC 🪙🥳

While most of us mark October 31st with costumes and candy, this day has more significance than you might expect.

For example, it was also when Martin Luther issued his 95 theses in Wittenberg, Germany, in 1517, sparking the Reformation.

But that’s not all.

On October 31st, 2008, a person (or persons) under the pseudonym Satoshi Nakamoto introduced the world to Bitcoin through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

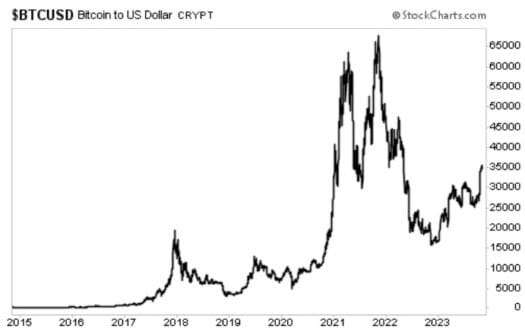

And just like that, the world’s first cryptocurrency was born fifteen years ago.

This nine-pager wasn’t just a blueprint of a new cryptocurrency but a foundation stone for a technology that promised to redefine how we perceive and transfer value in the digital realm. The whitepaper explained the principles of cryptographic hashing, the architecture of blocks, and the timing mechanisms essential for sustaining them.

Among the innovations outlined in the paper is the proof-of-work system stands out (even though it wasn’t Satoshi’s brainchild). Adapting ideas like Adam Back’s “Hashcash,” the proof-of-work concept was tailored to tackle the double-spending issue, ensuring every transaction on the network was validated through consensus instead of a central authority.

As I’ve explained before, many people predicted the advent of cryptocurrency before Nakamoto. And some even outlined the broad strokes of how it might function. But it wasn’t until Bitcoin came along that we had a potentially functioning global payment rail whose decentralized nature allowed transactions beyond the clutches of government-controlled fiat currency.

So far, the robustness of this model has stood the test of time. Over 15 years, the Bitcoin blockchain has grown in both size and strength. As the network expanded, the mining ecosystem morphed into a domain dominated by massive institutional-grade companies. And today, we have a who’s who of traditional finance heavyweights vying for their piece of the pie. Or should we say… birthday cake? 🍰

Closing Thoughts

That’s all we have for this week. But before I go, I want to make one thing clear…

As we’ve said before, Bitcoin may be the most fascinating and controversial development in money and finance in generations… if not centuries. And the underlying blockchain technology has the potential to revolutionize our economy.

We firmly believe that we’re still in the early stages of that revolution. It will not only change the nature of finance and commerce, but it will also unlock enormous profit opportunities for investors.

While we can’t promise you’ll make the massive profits witnessed from crypto’s infancy, we still think some investors still have time to make life-changing gains. That’s why we released a special briefing with all the details you need to know. Go here to see it now.

This article originally appeared on StreetAuthority.com.