Which Sectors Are Off to a Hot Start in 2023?

Sector performance is cyclical. It generally follows the business cycle.

A typical business cycle has four phases that reflect different fluctuations of the economy: early cycle phase, mid-cycle phase, late-cycle phase, and recession phase.

The early cycle phase marks a recovery from a recession. Monetary policy is eased, and sales and margins expand.

During the mid-cycle, the economy experiences moderate growth. Profits are healthy, and monetary policy is fairly neutral. The stock market usually experiences consistent growth during this phase.

During the late-cycle, which we were in for much of 2022, economic growth rates start to slow as credit tightens. The transition into this phase can be marked by increasing stock market volatility.

Economic growth contracts during the recession phase, which typically follows the late-cycle phase.

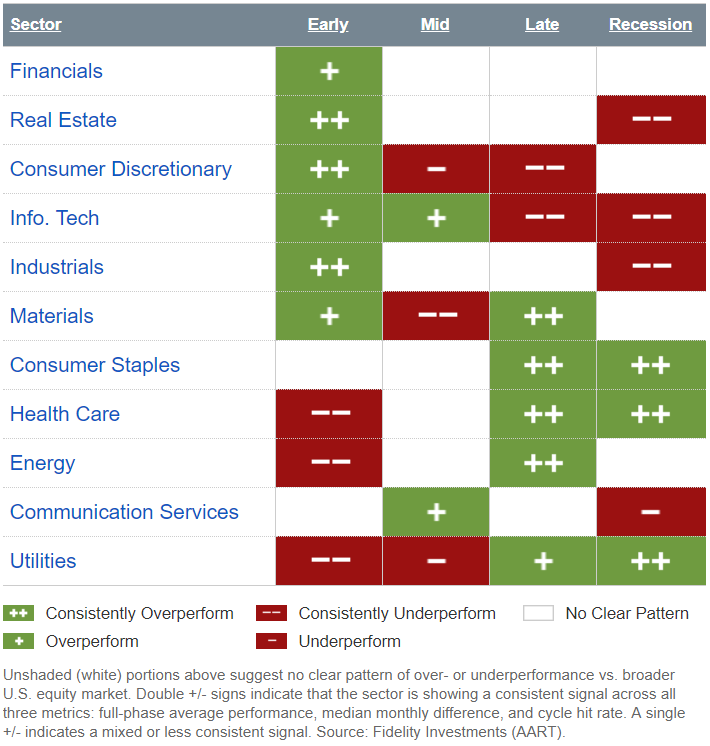

Although my strategy is always to remain fully diversified at all times, some investors may try to time the business cycle. Different sectors historically perform differently during the different cycles. So it pays to understand what is likely to perform best during each cycle.

For the past two years, energy has been the top-performing sector. And, according to Fidelity, energy is a consistent top performer during the late business cycle.

Source: Fidelity Investments

Three sectors have historically held up well during a recession: utilities, health care, and consumer staples. These sectors are of considerable interest during the late business cycle. Not only do they generally outperform during this phase (all three outperformed the S&P 500 in 2022), but they are consistent outperformers during the recession phase. If the current business cycle follows the typical pattern, then we are in a period where these sectors are likely to continue outperforming the broader markets.

One of my 2023 predictions was that the energy sector would lag. I also wrote in my wrap-up of 2022 that I felt like we had seen the bottom for the technology and telecom sectors, and that I wouldn’t be surprised to see a bounce in these sectors this year.

WATCH THIS VIDEO: Big Tech Hits a Speed Bump

My view wasn’t based entirely on the business cycle, although the markets are generally forward looking. We can see that communication services typically perform poorly during a recession, which many believe we will see this year, but the sector has already underperformed for two straight years.

So, what have we seen so far in 2023? Communication services is actually the top-performing sector thus far this year, against an S&P 500 performance of +7.7%. Since the beginning of the year, here are the performance numbers for every sector:

- Comm. Services: +21.3%

- Cons. Disc.: +17.2%

- Technology: +13.9%

- Real Estate: +10.9%

- Materials: +7.4%

- Financial: +7.0%

- Industrial: +4.7%

- Consumer Staples: -1.5%

- Energy: -1.7%

- Health Care: -2.3%

- Utilities: -3.7%

This is directionally more or less in line with my expectations for this year, although communication services and technology are both ahead of the pace I would have expected. I have expected a pullback in the energy sector, and we have seen that thus far. The utilities sector is also underperforming based on historical observations.

Of course we won’t know until we have the benefit of hindsight whether technology and communication services are simply experiencing a bear market rally, or whether this rally can sustain itself through the rest of 2023.

Editor’s Note: As our colleague Robert Rapier just explained, the tech sector has rebounded so far in 2023 and could be positioned for substantial gains in the year ahead. Which brings us to another expert worth following: Dr. Joe Duarte.

In a new report, Dr. Duarte pinpoints a groundbreaking tech disruption worth $75 trillion (yup, that’s trillion with a “t”), and it all starts with one under-the-radar $3 stock.

Dr. Duarte is the chief investment strategist of our premium trading services, Profit Catalyst Alert and Weekly Cash Machine. He currently recommends an investment opportunity in the tech sector that’s poised for market-crushing gains. Learn more by clicking here.