The Global Resource Bargain Hunt Is On

In the background of almost everything that goes on in Australia these days lurks China. On most of the US-centric world maps we see in the Northern Hemisphere the Middle Kingdom literally looms over the Land Down Under.

It’s undeniably true that China’s economic growth has had a direct, beneficial impact on Australia’s fortunes in the 21st century. It’s probably the greatest single reason Australia avoided a recession while the rest of the world sank from 2007 to 2009. Much like Canada, its resource-rich Commonwealth Cousin, stable institutions over the long term, coupled with generally responsible recent political management have positioned Australia for further expansion because of China’s still-growing demand for commodities.

Even more than the Great White North, for which the US is and will remain the biggest bilateral trade partner, Australia depends on this still-emerging economic giant. But like Canada, too, which is and must continue to become more of a multi-trick pony, Australia does business with other important economies.

Canada’s trade minister last week visited Beijing to continue laying the foundation for a broad agreement between the two countries that will facilitate investment, another step that will help further reduce overreliance on the US. “Diversification” is a byword at the level of geopolitics and investing as well.

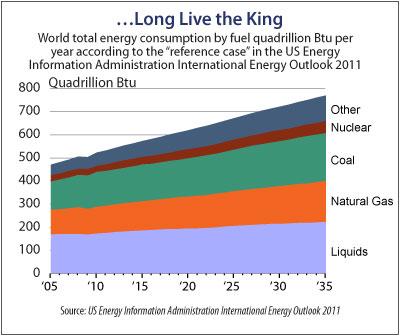

Assessing China’s impact on the supply-demand equation of countless goods, services and commodities will certainly help us understand Australia’s place in a rapidly changing global economy. We know that China–and India, for that matter, and other emerging Asian economies as well–will have increasing need for power as its population urbanizes and further develops middle-class appetites. This is one of the most well-known trends known to man: demand for electricity is rising.

What gets overlooked too often is that there are existing demand trends in place as well. Japan, for instance, the world’s third-biggest economy, consumes more electricity than any other country except China and the US.

Take a closer look at Australia’s coal exports. In 2010 it exported 300.6 metric tons, up from 274 metric tons in 2009 and 233.5 in 2008. These substantial increases at a time of weak global economic growth reflect yet again the importance of fundamental supply and demand issues that are often more important to the detail of the dry-bulk market than the overarching macro view.

It might also be noted that the 70 metric tons of increased exports China was not responsible for any of the net increase. Exports of coal from Australia to China fell by 9.4 metric tons 36.3, though exports of iron ore did increase by 7.9 metric tons to 274.5. Combined there was a net reduction of 1.5 metric tons.

The 70 metric ton increase came from Japan, which saw its requirements from Australia rise by 17 metric tons for coal and by 16.6 metric tons for iron ore, accounting for almost half of the increase. South Korea accounted for 15 metric tons, and other emerging Asian economies accounted for the balance, albeit with a significant increase in coking coal exports to Europe.

Japanese imports of coal were forecast to increase in 2011 even before the full impact of the Mar. 11 earthquake and subsequent tsunami that rocked the Fukushima-Daiichi nuclear power plant. But Japan’s imports of liquefied natural gas (LNG) and thermal coal rose to a record in August because of low utilization rates at still-functioning nukes; LNG imports climbed 18.2 percent from a year earlier to 7.55 million metric tons, while thermal coal imports increased 7.1 percent to 10 million tons.

The operating rate for nuclear power plants fell to 26.4 percent in August, the lowest since Japan’s Federation of Electric Power Companies started compiling data in April 1977. Power generation at thermal plants rose 8.2 percent, while total electricity output by utilities dropped 12.1 percent on lower temperatures and efforts to conserve energy.

Coal is an increasing part of the power solution in China and in developed Japan, and it will remain a crucial part of the global equation as well at least as far out as 2035. Closer to the ground, in March 2010 the Australian Bureau of Agricultural and Resource Economics and Sciences ((ABARES)) forecast growth in Australia’s exports from 274 metric tons 2009 to over 390 metric tons in 2015, driven by the increasing coal demand from the emerging economies, particularly China and India. ABARES forecast a 22 percent growth in metallurgical coal, used in steelmaking, and 42 percent growth in thermal coal, burned to produce electricity, in that period.

Based on actual numbers it looks like 390 may come earlier. But this growth in demand explains why New Hope Corp Ltd [ASX: NHC], (OTC:NHPEF.PK), which produces thermal coal exclusively and also owns a key export facility, recently put itself up for auction after receiving “numerous” of unsolicited inquiries about its availability for sale. A more formal process is unlikely to draw the sort of announced premium (72 percent) that China Petroleum & Chemical Corp Ltd–better known asSinopec (NYSE: SNP)–is paying for Canada-based oil and gas producerDaylight Energy Ltd [TSX: DAY], (OTC: DAYYF.PK). And at the end of any transaction–and this is the most important point you’ll read in this space today–you want to own stock in a business that you’d own whether a takeover offer emerges or not. Our primary interest is in building wealth over the long term.

At the same time, as much as understanding Chinese economic growth helps us understand Australian investment opportunities, the New Hope experience helps us understand potential value in the Basic Materials space.

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account