Healthcare Spotlight: CSL Ltd.

The compelling argument in favor of health care stocks is that they offer defensive cash flows over the long term. In a punch-drunk market where every stumble or turn is bound to be characterized as the sign of the inevitable, final knockout for the system and economy as we know it by a sizable chunk of the commentariat, “predictability” is a hot commodity.

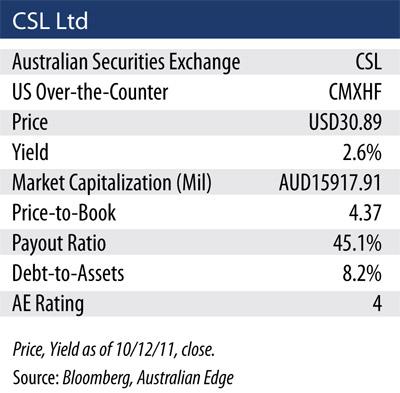

So says the stock chart of CSL Ltd (CMXHF.PK), a Melbourne-based maker of blood-plasma therapies and other pharmaceuticals. Since mid-October 2006 the stock is up more than 100 percent in price terms only, 140 percent including a dividend that hasn’t been cut during that time frame.

At a time when growth is both sluggish and jagged, less leverage to future economic activity is a definite positive trait in an investment vehicle. But the case for CSL is based on more than its capabilities as an investor redoubt.

In broad terms, in many developed economies aging populations demand–and are receiving–high-quality health care. Middle-class consumers in these markets are accustomed to regular checkups and ongoing “well-care” visits with doctors in addition to taken-for-granted, in the vast majority of cases, sick and acute care.

Emerging economies continue to grow, begetting a new global middle class that’s demanding higher-quality care, not quite–yet–along the lines of what’s provided in the West but certainly better. Growth trends here and continuing demand forecasts from the developed world portend significant opportunities for well-placed health care companies.

CSL’s best-known product on U.S. shores is perhaps the human papillomavirus (HPV) vaccine Gardasil, which it co-markets with Merck & Co (MRK).

The Gardasil case typifies the opportunities available in the West, as a presidential-primary-debate level controversy arose over efforts – successful, mind you – to have it included among required immunizations for girls of elementary-school age. Setting aside the specifics of whether Rep. Michele Bachmann (R-MN) or Gov. Rick Perry (R-TX) is right, in the West its possible for pharmaceutical companies to win market share based on government sanction of drugs and therapies under public health insurance plans.

This is the future for emerging Asian economies such as China. Global demand suggests that exposure to the healthcare sector could be a great means of building wealth over time, as earnings and dividend growth are typically resilient in the long term and new catalysts are entering the market every second.

Apart from the notoriety derived from Gardasil, which did contribute meaningfully in the form of royalty payments on a patent CSL owns and is set to do so in the future as its benefits are better understood, CSL is the world’s second-biggest maker of blood-derived therapies, behind Deerfield, Illinois-based Baxter International Inc (BAX).

Blood plasma products are used to treat patients with immune deficiency disorders, hemophilia, wounds and burns. Blood-plasma derivatives are the basis of vaccines, antivenom and cell culture reagents used in various other medical and genetic research and manufacturing applications.

Founded in 1916 as the Commonwealth Serum Laboratories, a government agency focused on the manufacture of vaccines. It was privatized via an initial public offering (IPO) of shares in June 1994 at AUD2.30 per share.

In 2000 CSL doubled its size through the purchase of Bern, Switzerland-based ZLB Bioplasma AG. In 2004, during a period of plasma oversupply, the company expanded again with the purchase of the German medical company Aventis Behring. The company’s headquarters remain in Parkville, Victoria, an inner suburb of Melbourne. CSL Behring is headquartered in King of Prussia, Pennsylvania, and has manufacturing operations in Bern, in Marburg in Germany, and Kankakee, Illinois.

One of its key markets is flu vaccines in the U.S.; the company is actually currently distributing vaccines for the 2011-12 season. Management recently refuted reports that the FDA had found flaws in its manufacturing process during inspections in April 2010 and again in March 2011 of the company’s influenza vaccine operations.

CSL said in a statement the FDA’s inspection reports contained “observations,” and that observations of influenza vaccine operations from an April 2010 inspection had been addressed to the FDA’ satisfaction.

In early October CSL started marketing a USD250 million bond sale to private U.S. investors. The company is seeking to sell debt in seven-, 10-, 12- and 15-year tranches after announcing in September that it planned to “modestly leverage” its balance sheet with a private placement in the U.S. and new bank loans. Management said it was targeting a total of about AUD1 billion (USD1.02 billion).

The company will use the proceeds to repay AUD385 million of loans due in 2012 and may buy back as much as AUD900 million of shares.

Results for fiscal 2011, reported in August, missed market expectations largely because of negative currency impacts. Australian dollar-reported earnings are impacted from euro revenues, which account for about 31 percent of the overall, and US dollar revenues, which account for about 40 percent.

CSL reported net profit after tax of AUD941 million for the 12 months ended Jun. 30, 2011, down AUD112 million or 11 percent from fiscal 2010. The result included an unfavorable foreign exchange impact of AUD116 million. On a constant currency basis operational net profit after tax–or “underlying” profit–grew 14 percent; exclusions include a one-off contribution from the sale of pandemic influenza vaccine (H1N1) in the prior period.

Sales revenue of AUD4.2 billion was up 9 percent on an underlying basis versus the 12 months ended Jun. 30, 2010. Research and development expenditures of AUD325 million were up 9 percent in constant currency terms. Cash flow from operations totaled AUD1.018 billion.

CSL’s balance sheet includes AUD479 million in cash against total debt of AUD416 million. Management declared a final dividend of AUD0.45 per share payable Oct. 14 to shareholders of record as of Sept. 23, bringing total ordinary dividends per share for fiscal 2011 to AUD.0.80. The next interim dividend will be declared on or around Feb. 15, 2012, for payment in early April 2012. I like that the stock is trading at a price-to-earnings multiple of around 17, well below a long-term sector average of just above 23 times, and continue coverage of CSL for my investment advisory service: Aussie Edge.

Stock Talk

Add New Comments

You must be logged in to post to Stock Talk OR create an account